Fees on unusually modest mortgages — a $fifty,000 house loan, by way of example — are generally bigger than regular charges due to the fact these loans are a lot less worthwhile to the house loan lender.

The surprise attributable to the sudden boost in interest prices about the morning of September 17, which may have led lenders to halt their lending until eventually they might Acquire extra information regarding the marketplace conditions[55]

Whilst we could seek to guess determined by historical information, no person is aware for certain what will take place to upcoming mortgage loan charges as time passes — whether they’ll change at all, or when.

Keep watch over every day amount modifications. However, if you get a great home finance loan level quote right now, don’t wait to lock it in.

The frequency of federal scholar loan defaults was calculated for and printed In this particular 2020 SBPC Examination. The Examination merged Each individual from the quarterly 2019 new Direct Loan defaults printed via the U.

This transfer could relieve substantial upward strain on mortgage charges, perhaps bringing about a more sizeable fee drop. We’ll must wait around and find out if fees breach the Significantly anticipated 6% mark in 2024.

In 2023, the landscape remained complicated. While lots of expected rates to relieve, persistent economic pressures and world wide things saved upward momentum alive. Federal Reserve efforts to temper charge hikes brought small relief, and volatility continued to define the home loan market place.

The will cause of the speed spike weren't quickly very clear. Economists later discovered its main trigger being a temporary shortage of money obtainable in the fiscal technique, which was by itself due to two gatherings taking place click here on September sixteen: the deadline for your payment of quarterly company taxes as well as issuing of recent Treasury securities.

Rising household development must also support boost conditions for 2020 homebuyers, though household costs are anticipated to maintain soaring.

You can also make use of a mortgage calculator with taxes, insurance coverage, and HOA dues involved to estimate your full property finance loan payment and residential shopping for spending budget.

University student loan default is a disaster and on the list of numerous ways the federal authorities punishes individuals for becoming too bad to pursue the “American dream” they ended up promised.

Particularly substantial rates and an Over-all potent financial state have led the Federal Reserve to acquire drastic actions, employing a rapid succession of rate boosts unseen since the early eighties. These measures have involved 4 historic charge hikes of seventy five basis details (0.

Bear in mind you’re not stuck together with your mortgage loan price without end. If costs drop substantially, homeowners can always refinance afterwards to cut expenses.

If at all possible, give yourself a number of months or perhaps a yr to improve your credit score score just before borrowing. You might help save A large number of bucks with the life of the loan.

To grasp right now’s mortgage costs in context, Consider the place they’ve been throughout history.

Considering that fascination payments Engage in out as time passes, a consumer who options to offer the home or refinance in a handful of several years must possibly skip the lower price details and spend an increased curiosity price for quite a while.

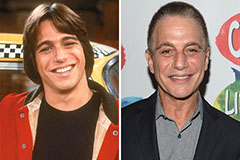

Tony Danza Then & Now!

Tony Danza Then & Now! Kirk Cameron Then & Now!

Kirk Cameron Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!